11/06/2025

Why Are Inflation Expectations Important?

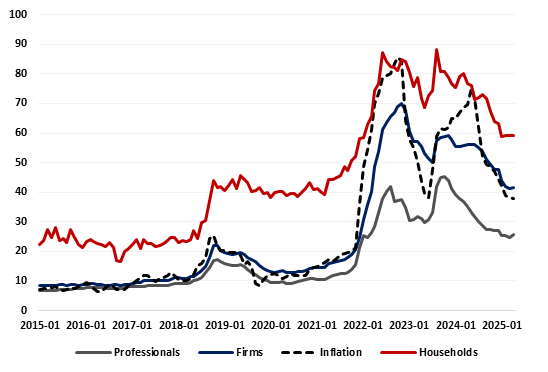

In an economy like Turkey’s, where prices are constantly rising, understanding inflation expectations is of great importance. Inflation expectations show what people think inflation will be in the coming months or years. So why are these expectations so important?

Because expectations shape reality.

When people think inflation will rise in the future, they take precautions today and try to protect themselves from price increases. Consumers bring their shopping forward, stock up, or demand higher salaries. Companies start raising their prices and creating relatively long-term contracts in line with these expectations, thinking that costs will increase. Professionals, on the other hand, carry out asset pricing according to these expectations. This set of behaviors causes expectations to turn into inflation itself over time.

That’s why central banks like the Central Bank of the Republic of Turkey (CBRT) keep a close eye on inflation expectations. If expectations are “anchored”—that is, if people trust that inflation will be kept under control—central bank policies are more effective and inflation is easier to control. Because if everyone believes in the same expectation anchor, that expectation turns into realized inflation. It wouldn’t be wrong to call this a “self-fulfilling prophecy.” But if expectations get out of control, the economy starts to sail through stormy waters like a ship without a compass, and no one can predict where realized inflation will end up. This environment of uncertainty is the last thing policymakers want.

So, whose expectations are more important? Households make their consumption and savings decisions based on inflation expectations. Therefore, households can put pressure on prices through demand. But at the end of the day, it is companies that determine prices and salaries. Therefore, perhaps we should listen to the expectations of companies the most. If companies expect inflation to increase, they increase their prices, adjust their contracts according to this expectation, and offer their customers prices in line with this expectation. They may also have to offer higher salaries to avoid losing their employees to other companies. Such steps will further increase the actual inflation.

These results are not based solely on theoretical models. Recent empirical studies have shown that there is a strong correlation between firms’ inflation expectations and pricing, employment, investment, and borrowing decisions, especially during periods of high inflation. If firms expect inflation to fall, they become more optimistic about the future, less inclined to increase their prices, and more willing to invest. In short, confidence in the future increases as uncertainty decreases.

In short, inflation expectations are not just a forecasting tool, they are a policy target for economic stability. If we want to steer the economy in the right direction, understanding what firms expect regarding inflation can be one of the most powerful compasses we have.